content

Our History

In 1999, the National Pension Service Investment Management (NPSIM) was launched to ensure that the National Pension Fund is professionally managed by investment professionals with in-depth expertise across all asset classes. Since then, the NPSIM has been constantly advanced in terms of capacity and organization to effectively cope with the rapidly growing size and an increasingly volatile investment landscape.

컨텐츠내용시작

2022 ~ 2024

-

2024

Formed the Global Investment Planning Team, Private Debt Investment Team, Real Estate Platform Investment Team, Investment HR Dept., Investment Tax Dept.

-

2023

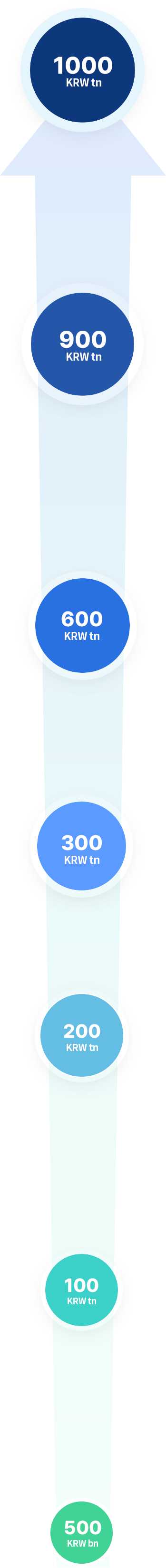

Achieved KRW 1,000 trillion in total Fund

-

2022

Reorganized Risk Management Division(Public Market, Private Market)

-

2021

Reorganized Global Public Market Division by asset class (Global Equity, Global Fixed Income) Achieved KRW 900 trillion in total Fund

-

2020

Created Managing Director positions (Investment Strategy, Risk Management, Investment Operation) Achieved KRW 800 trillion in total Fund

-

2019

Reorganized Alternative Investment Division by asset class (Private Equity, Real Estate, Infrastructure)

Formed the Global Responsible Investment Division, IT Division and External Affairs Division Achieved KRW 700 trillion in total Fund -

2018

Adopted its Responsible Investment & Governance Principles (Stewardship Code)

-

2017

Achieved KRW 600 trillion in total Fund

-

2015

Formed the FX Management Team and Global Infrastructure Team

Opened the Singapore Office Achieved KRW 500 trillion in total Fund -

2013

Formed the Responsible Investment Team Achieved KRW 400 trillion in total Fund

-

2012

Enhanced operational support functions

Opened the London Office -

2011

Reorganized Global Investment Division by asset class (Global Public Market, Global Alternative Investment)

Opened the New York Office

2008 ~ 2010

-

2010

Granted Independence to Compliance Officer Achieved KRW 300 trillion in total Fund

-

2009

Commenced internal management in global equities

Became a signatory to PRI -

2008

Reorganized Global Investment Division and Alternative Investment Division

2004 ~ 2007

-

2007

Reorganized investment divisions by asset class Formed the External Affairs Team and Compliance Officer Achieved KRW 200 trillion in total Fund

-

2006

Formed the Global Investment Team

Established the Alternative Investment Committee -

2005

Commenced external management in global fixed income

Commenced global alternative investment -

2004

Commenced external management in domestic fixed income

Formed the Alternative Investment Team

2000 ~ 2003

-

2003

Commenced internal management in global fixed income Achieved KRW 100 trillion in total Fund

-

2002

Commenced domestic alternative investment

Commenced external management in global equities -

2001

Formed the Fund Management Division

Established the Risk Management Committee -

2000

Commenced external management in domestic equities

1988 ~ 1999

-

1999

Established the NPSIM (6 teams, 40 employees)

Established the Investment Committee -

1988

Established the National Pension Fund