content

Domestic Equity

The NPS has a long-term investment horizon. Its strategy targets assets with intrinsic values greater than their market values. Investments in domestic equities are made both internally within its investment universe and through external managers in line with its portfolio management strategy for each sub-asset class.

Overview

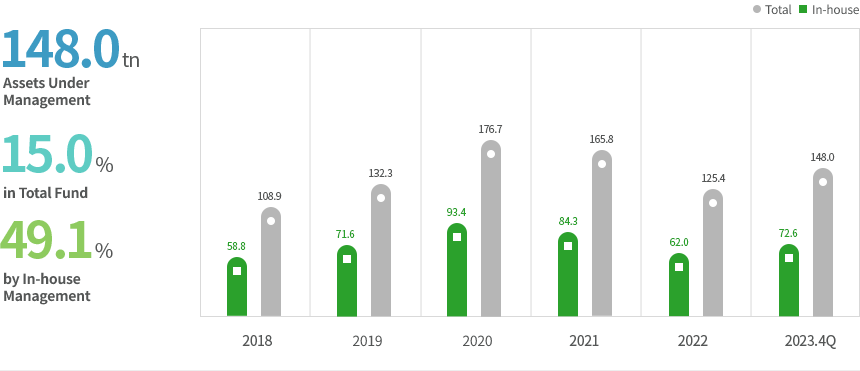

(in trillion won, as of the end of Q4 in 2023)

Asset Value Of the Domestic Equities 148.0, Weight in the Total Fund 15.0%, In-house Management Portion of the Domestic Equities 49.1%

| year | Total | In-house |

|---|---|---|

| 2018 | 108.9 | 58.8 |

| 2019 | 132.3 | 71.6 |

| 2020 | 176.7 | 93.4 |

| 2021 | 165.8 | 84.3 |

| 2022 | 125.4 | 62.0 |

| 2023. 4Q | 148.0 | 72.6 |

- Until a fund management assessment is completed, preliminary estimates are provided.

- The figures above might not add up due to rounding.

Sector Composition

(As of the end of 2022)

- IT 30.3%

- Industrials 16.8%

- Materials 10.0%

- Financials 9.4%

- Consumer Discretionary 9.3%

- Health Care 7.6%

- Communication Services 7.5%

- Communication Staples 5.2%

- Energy, Utilities, Real Estate, etc. 3.9%

- Data on assets by sector, geography, issuer or type as of the end of the fiscal year is disclosed in the third quarter of the following year according to Article 25 of the Guideline for National Pension Fund Management and Article 39 of the Regulation on National Pension Fund Management.

- The figures above might not add up due to rounding.

Top10 Holdings

(in 100 million won, as of the end of 2022)| No. | Company | Amount | Weight | Holding |

|---|---|---|---|---|

| 1 | Samsung Electronics | 248,521 | 20.0% | 7.5% |

| 2 | LG Energy Solution | 54,757 | 4.4% | 5.4% |

| 3 | Samsung Biologics | 39,620 | 3.2% | 6.8% |

| 4 | SK Hynix | 39,288 | 3.2% | 7.2% |

| 5 | Samsung SDI | 32,126 | 2.6% | 7.9% |

| 6 | LG Chem | 31,578 | 2.6% | 7.5% |

| 7 | NAVER | 24,627 | 2.0% | 8.5% |

| 8 | Hyundai Motor | 22,550 | 1.8% | 7.0% |

| 9 | POSCO HOLDINGS | 21,328 | 1.7% | 9.1% |

| 10 | Celltrion | 17,204 | 1.4% | 7.6% |

Data on assets by sector, geography, issuer or type as of the end of the fiscal year is disclosed in the third quarter of the following year according to Article 25 of the Guideline for National Pension Fund Management and Article 39 of the Regulation on National Pension Fund Management.