content

Risk Management

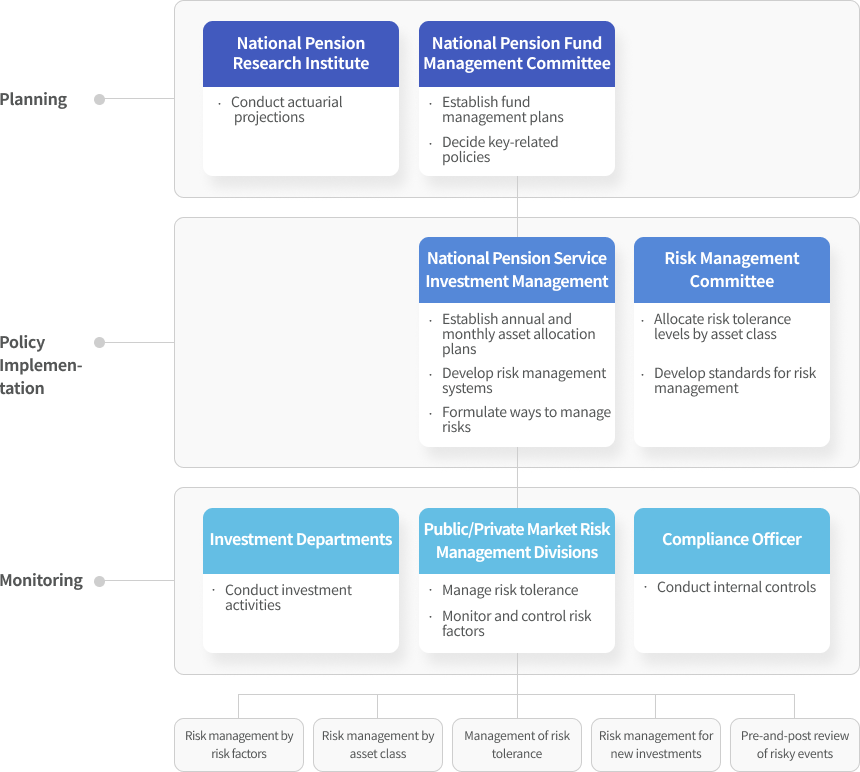

In order to rapidly adapt to the fast-changing investment landscape at home and abroad, the NPS closely monitors potential risks at all times through its multi-layered risk management systems. The Risk Management Committee, chaired by the CEO and comprised of CIO and external experts, develops risk management processes and standards, as well as adopts risk budgeting strategies, while risks associated with investments are addressed by the Public Market Risk Management Division and Private Market Risk Management Division. Internal controls are conducted by an independent Compliance Officer, and internal audits are carried out by an internal audit team. In addition, external audits are undertaken from time to time by third parties, including the Board of Audit and Inspection, the National Assembly, etc.

Risk Management Process

-

Planning

- National Pension

Research Institute -

- Conduct actuarial projections

- National Pension Fund

Management Committee -

- Establish fund management plans

- Decide key risk-related policies

- National Pension

-

Policy

Implementation- National Pension Service

Investment Management -

- Establish annual and monthly asset allocation plans

- Develop risk management systems

- Formulate ways to manage risks

- Risk Management Committee

-

- Allocate risk tolerance levels by asset class

- Develop standards for risk management

- National Pension Service

-

Monitoring

- Investment Departments

-

- Conduct investment activities

- Public/Private Market Risk Management Divisions

-

- Manage risk tolerance

- Monitor and control risk factors

- Compliance Officer

-

- Conduct internal controls

- Risk management

by risk factors - Risk management

by asset class - Management of

risk tolerance - Risk management

for new investments - Pre-and-post review

of risky events

Risk Measurement

Acceptable risk tolerance levels are set for each asset class based on expected returns and estimated risks to construct optimized portfolios within the set limits.

- Benchmark Returns (%) and Asset Allocation for Each Asset Class are defined in annual fund management plans.

- Target Return (%) is set to pursue a long-term return close to “Real GDP Growth (%) + CPI Inflation (%) ± Adjustments”.

- Adjustments are determined by the National Pension Fund Management Committee with a view to achieving target returns within acceptable risk tolerance levels.

- Risk Tolerance is subject to CVaR(α=0.05) ≥ -15% and determined by a combination of factors, including an expected minimum reserve ratio in five years, annual loss probability and shortfall risk.