content

Returns

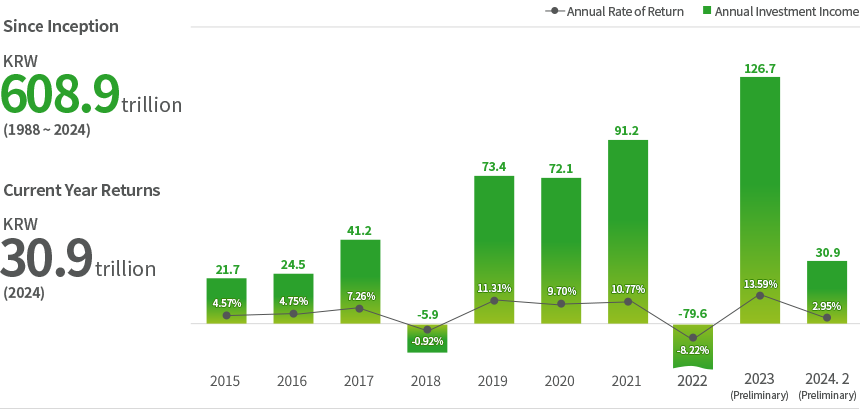

Amid the growing volatility of economic and financial environment at home and abroad, the NPS is fully committed to delivering solid returns to help maintain the long-term financial stability of pension funds. In principle, the performance of the fund is assessed for a three-year period or longer every June.

Investment Performance

(in trillion won, as of end-Jan. 2025)

Accumulated Return is 748.1 trillion, Current Year Returns is 10.4

2016year is 24.5 trillion(Accumulated Return), Accumulated Annualized Return is 4.75%.

2017year is 41.2 trillion(Accumulated Return), Accumulated Annualized Return is 7.26%.

2018year is -5.9 trillion(Accumulated Return), Accumulated Annualized Return is -0.92%.

2019year is 73.4 trillion(Accumulated Return), Accumulated Annualized Return is 11.31%.

2020year is 72.1 trillion(Accumulated Return), Accumulated Annualized Return is 9.70%.

2021year is 91.2 trillion(Accumulated Return), Accumulated Annualized Return is 10.77%.

2022year is -79.6 trillion(Accumulated Return), Accumulated Annualized Return is -8.22%.

2023year is 126.7 trillion(Accumulated Return), Accumulated Annualized Return is 13.59%.

2024year is 159.7 trillion(Accumulated Return), Accumulated Annualized Return is 15.00%.

2025year is 10.4 trillion(Accumulated Return), Accumulated Annualized Return is 0.85%.

- All rates of return (%) in the chart above are money weighted. The rate of return for the current year is a year-to-date (YTD) return, not annualized.

- The annualized return for the current year is 1.66%

- Until a fund management assessment is completed, preliminary estimates are provided.