content

Shareholder Activities

The NPS pursues long-term, stable returns through the exercise of voting rights and shareholder engagement with an aim of enhancing shareholder value and encouraging companies to improve their ESG practices and develop more sustainable business practices.

Voting

The NPS exercises voting rights in investee companies when its shareholding ratio is more than 1% of the total shares of a company, and the holding of a company is more than 0.5% and 0.3% in its domestic and global equity portfolio, respectively.

-

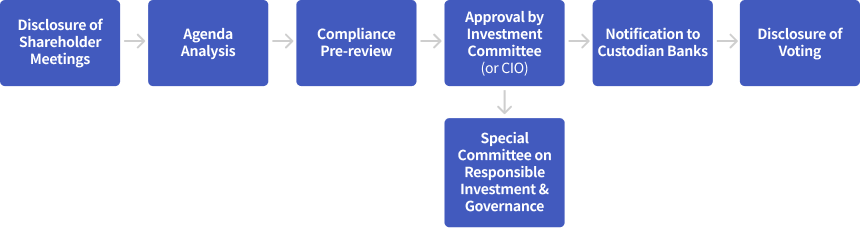

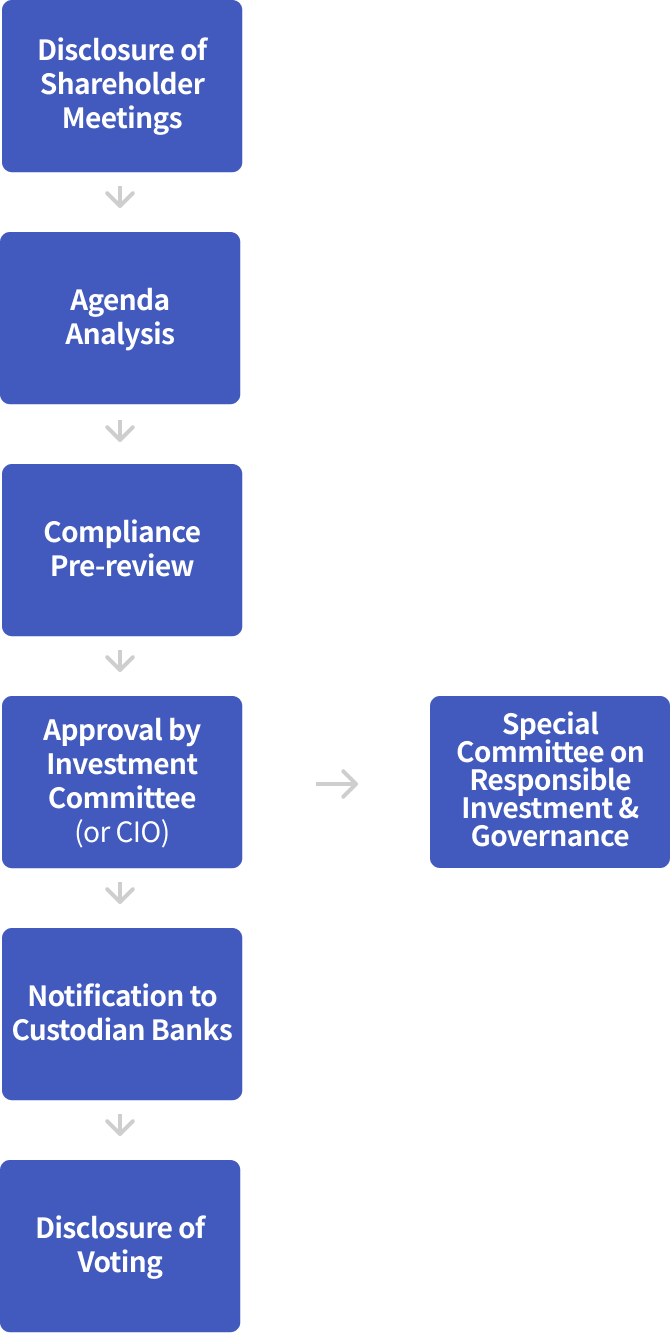

Procedure for exercising Voting rights

- Disclosure of Shareholder Meetings

- Agenda Analysis

- Compliance Pre-review

- Approval by Investment Committee(or CIO)

Special Committee on Responsible Investment & Governance

- Notification to Custodian Banks

- Disclosure of Voting

The Special Committee on Responsible Investment & Governance determines the direction of voting for matters that ▲ the NPS finds it difficult to make a decision internally, or ▲ more than one-third of the total number of members of the Committee consider having a significant impact on shareholder value over the long term.

Engagement

The NPS conducts shareholder engagement on six focus areas: ▲ dividend policy, ▲ remuneration cap for directors, ▲ violation of rules and regulations, ▲ repetitive vote against, ▲ climate change, and ▲ industrial safety. Moreover, the NPS actively participates in shareholder activities over ESG-related unexpected concerns that may harm shareholder or corporate value, and holds dialogues with companies to help enhance their long-term value.

-

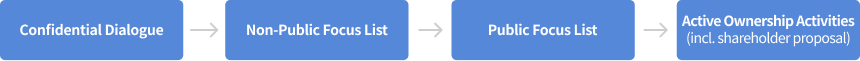

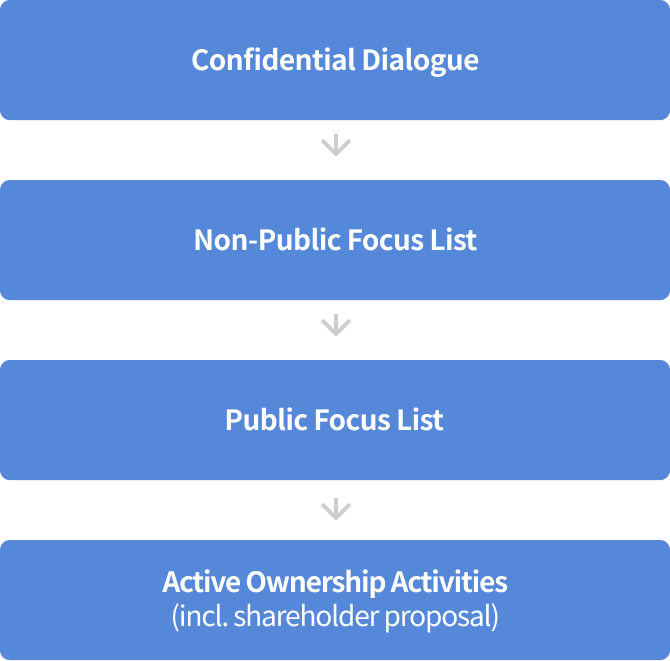

Engagement Steps for Focus Areas

- Confidential Dialogue

- Non-Public Focus List

- Public Focus List

- Active Ownership Activities(incl. shareholder proposal)

-

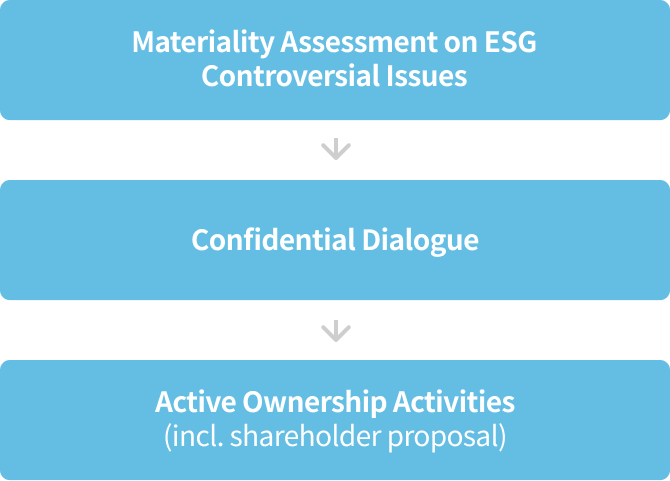

Engagement Steps for Unexpected Concerns

- Materiality Assessment on ESG Controversial Issues

- Confidential Dialogue

- Active Ownership Activities(incl. shareholder proposal)