content

Global Equity

The NPS invests in a range of equities in the global market, especially listed equities, as part of its investment diversification strategy. Investments in overseas equities are made both internally within its investment universe and through external managers in line with its portfolio management strategy for each sub-asset class.

Overview

(in trillion won, as of the end of Q2 in 2024)

Asset Value Of the Overseas Equities 390.8, Weight in the Total Fund 34.1%, In-house Management Portion of the Overeas Equities 44.0%

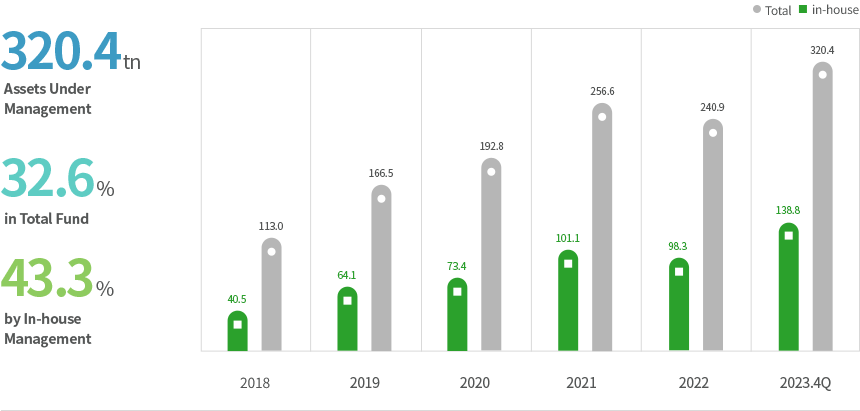

| year | In-house | Total |

|---|---|---|

| 2019 | 64.1 | 166.5 |

| 2020 | 73.4 | 192.8 |

| 2021 | 101.1 | 256.6 |

| 2022 | 98.3 | 240.9 |

| 2023 | 138.8 | 320.4 |

| 2024. 2Q | 171.9 | 390.8 |

- Until a fund management assessment is completed, preliminary estimates are provided.

- The figures above might not add up due to rounding.

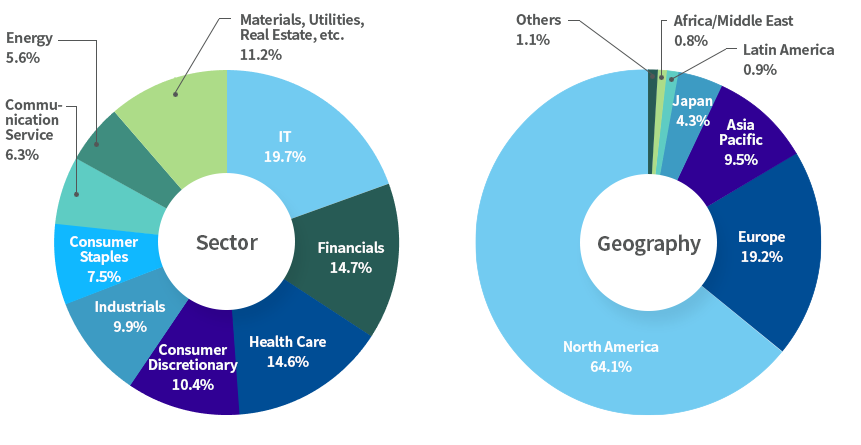

Sector/Geography Composition

(As of the end of 2023)

- Data on assets by sector, geography, issuer or type as of the end of the fiscal year is disclosed in the third quarter of the following year according to Article 25 of the Guideline for National Pension Fund Management and Article 39 of the Regulation on National Pension Fund Management.Fund Management and Article 39 of the Regulation on National Pension Fund Management.

- The figures above might not add up due to rounding.

Top10 Holdings

(in 100 million won, as of the end of 2023)| No. | Company | Amount | Weight | Holding |

|---|---|---|---|---|

| 1 | APPLE INC | 131,724 | 4.11% | 0.34% |

| 2 | MICROSOFT CORP | 111,496 | 3.48% | 0.31% |

| 3 | AMAZON.COM INC | 54,887 | 1.71% | 0.27% |

| 4 | NVIDIA CORP | 51,299 | 1.60% | 0.32% |

| 5 | INVESCO MSCI USA ETF | 44,306 | 1.38% | 81.32% |

| 6 | ALPHABET INC CL A | 42,801 | 1.34% | 0.40% |

| 7 | META PLATFORMS INC CLASS A | 41,638 | 1.30% | 0.41% |

| 8 | ALPHABET INC CL C | 33,359 | 1.04% | 0.32% |

| 9 | UNITEDHEALTH GROUP INC | 27,938 | 0.87% | 0.45% |

| 10 | NOVO NORDISK A/S B | 24,663 | 0.77% | 0.54% |

Data on assets by sector, geography, issuer or type as of the end of the fiscal year is disclosed in the third quarter of the following year according to Article 25 of the Guideline for National Pension Fund Management and Article 39 of the Regulation on National Pension Fund Management.