content

Domestic Fixed Income

The NPS seeks to maximize sustained long-term returns by holding bonds until their maturity and diversifying investments by type, issuer, industry (for corporate bonds) and maturity. In this process, the NPS pursues excess returns by adjusting duration within a certain range in consideration of several factors including credit ratings of issuers and spread over risk-free bonds.

Overview

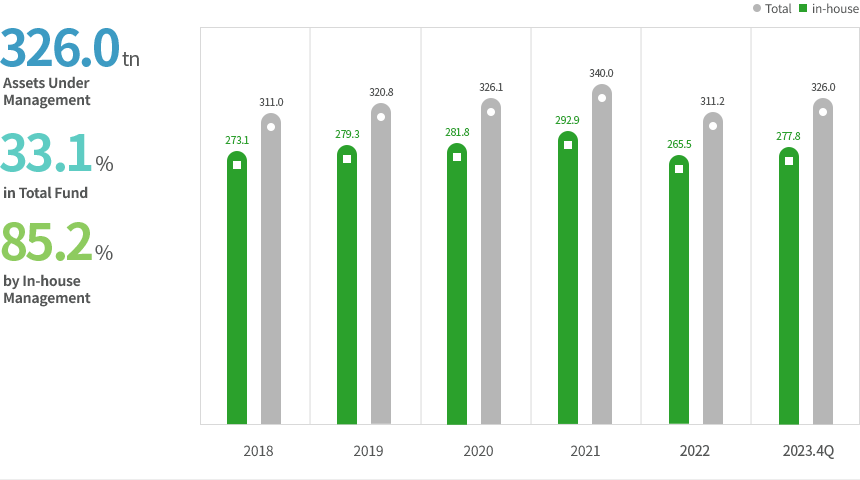

(in trillion won, as of the end of Q4 in 2024)

Asset Value Of the Domestic Fixed-income 344.3, Weight in the Total Fund 28.4%, In-house Management Portion of the Domestic Fixed-income 84.4%

| year | In-house | Total |

|---|---|---|

| 2019 | 279.3 | 320.8 |

| 2020 | 281.8 | 326.1 |

| 2021 | 292.9 | 340.0 |

| 2022 | 265.5 | 311.2 |

| 2023 | 277.8 | 326.0 |

| 2024. 4Q | 290.5 | 344.3 |

- Until a fund management assessment is completed, preliminary estimates are provided.

- The figures above might not add up due to rounding.

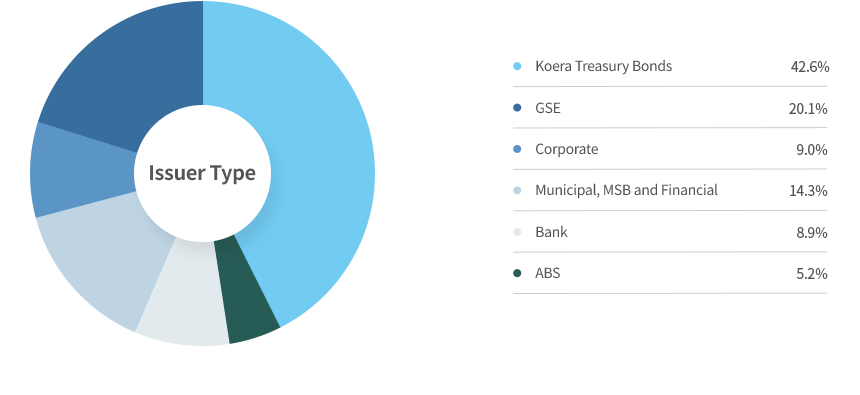

Sector Composition

(As of the end of Q4 in 2024)

- Korea Treasury Bonds 43.6%

- GSE 20.4%

- Corporate 8.4%

- Municipal, MSB and Financial 13.7%

- Bank 9.2%

- ABS 4.7%

The figures above provide a breakdown per issuer type as of the end of each quarter.

Top10 Holdings

(in 100 million won, as of the end of 2023)| No. | Issuer | Amount | Weight |

|---|---|---|---|

| 1 | Korea Treasury Bonds | 1,381,473 | 44.7% |

| 2 | Korea Housing Finance Corporation | 285,277 | 9.2% |

| 3 | Korea Electric Power Corporation | 137,062 | 4.4% |

| 4 | Bank of Korea | 124,077 | 4.0% |

| 5 | Korea Lands and Housing Corporation | 52,218 | 1.7% |

| 6 | Korea Development Bank | 40,642 | 1.3% |

| 7 | Seoul Metropolitan Government | 33,347 | 1.1% |

| 8 | Industrial Bank of Korea | 26,540 | 0.9% |

| 9 | Gyeonggi Province | 24,962 | 0.8% |

| 10 | Korea Gas Corporation | 24,817 | 0.8% |

Data on assets by sector, geography, issuer or type as of the end of the fiscal year is disclosed in the third quarter of the following year according to Article 25 of the Guideline for National Pension Fund Management and Article 39 of the Regulation on National Pension Fund Management.