content

Responsible Investment

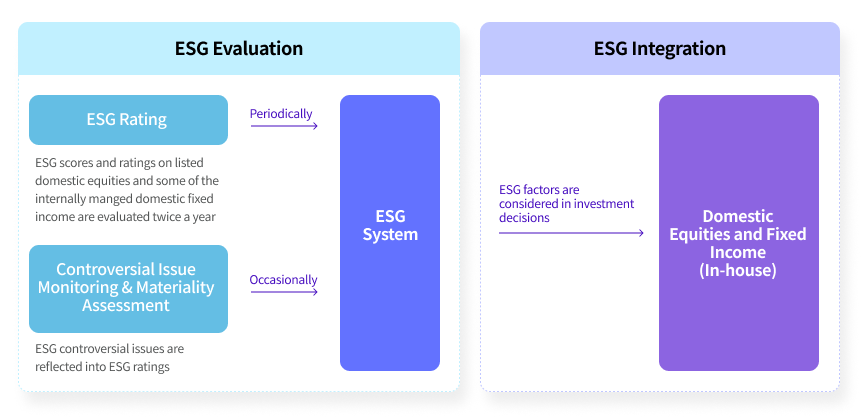

The NPS takes into account non-financial factors such as environmental, social and governance (ESG) aspects alongside financial factors in the investment decision-making process for equities and fixed income.

ESG Integration Process

The NPS strives to achieve ESG integration based on ESG evaluation. For listed domestic equities and some of the internally managed domestic fixed income, ESG evaluation is conducted twice a year, using a proprietary ESG evaluation system tailored to the characteristics of the National Pension Fund. In addition, ESG-related issues are frequently monitored while materiality assessments are undertaken, in order to actively identify and address material issues impacting value creation.