content

Global Fixed Income

The NPS invests in fixed income securities issued or guaranteed by foreign governments, central banks, or other competent authorities. Some portion of the fixed income investment is outsourced to external managers to boost returns and diversify risk by harnessing their expertise and experience.

Overview

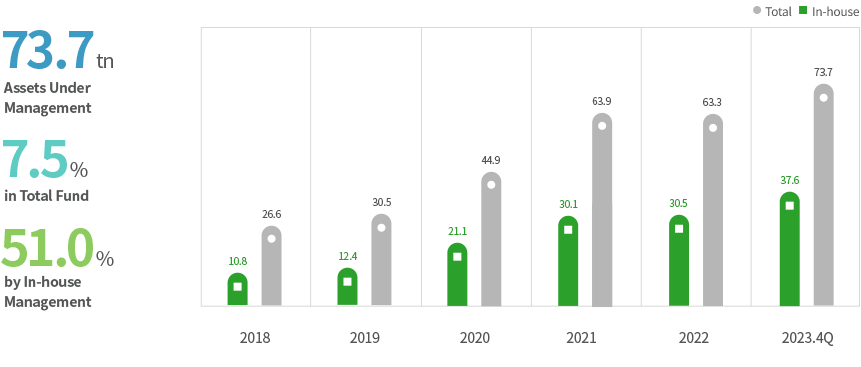

(in trillion won, as of the end of Q4 in 2024)

Asset Value Of the Overseas Fixed-income 88.3, Weight in the Total Fund 7.3%, In-house Management Portion of the Overeas Fixed-income 57.2%

| year | In-house | Total |

|---|---|---|

| 2019 | 12.4 | 30.5 |

| 2020 | 21.1 | 44.9 |

| 2021 | 30.1 | 63.9 |

| 2022 | 30.5 | 63.3 |

| 2023 | 37.6 | 73.7 |

| 2024. 4Q | 50.5 | 88.3 |

- Until a fund management assessment is completed, preliminary estimates are provided.

- The figures above might not add up due to rounding.

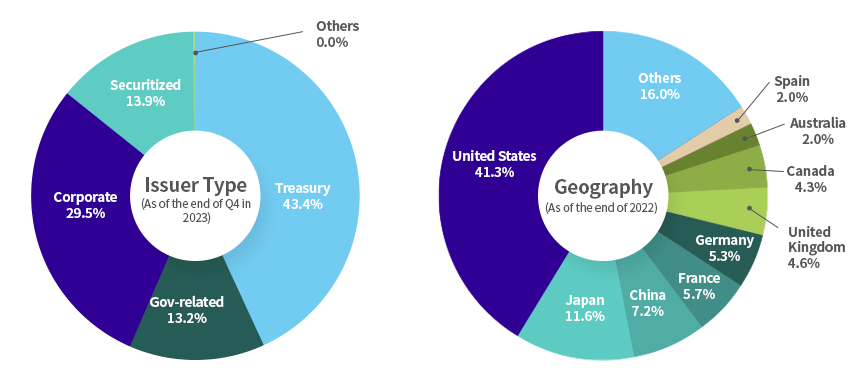

Sector Composition

- The figures above provide a composition by issuer type as of the end of each quarter.

- Data on assets by sector, geography, issuer or type as of the end of the fiscal year is disclosed in the third quarter of the following year according to Article 25 of the Guideline for National Pension Fund Management and Article 39 of the Regulation on National Pension Fund Management.

- The figures above might not add up due to rounding.

Top10 Holdings

(in 100 million won, as of the end of 2023)| No. | Item | Amount | Weight | Type |

|---|---|---|---|---|

| 1 | U S TREASURY NOTE5.000% 09/30/2025 DD 09/30/23 | 6,938 | 0.94% | TREASURIES |

| 2 | U S TREASURY NOTE4.625% 09/30/2028 DD 09/30/23 | 5,911 | 0.80% | TREASURIES |

| 3 | U S TREASURY BOND4.375% 08/15/2043 DD 08/15/23 | 5,659 | 0.76% | TREASURIES |

| 4 | U S TREASURY NOTE4.500% 11/15/2033 DD 11/15/23 | 5,420 | 0.73% | TREASURIES |

| 5 | U S TREASURY NOTE4.375% 08/31/2028 DD 08/31/23 | 3,409 | 0.46% | TREASURIES |

| 6 | U S TREASURY NOTE3.750% 04/15/2026 DD 04/15/23 | 3,156 | 0.43% | TREASURIES |

| 7 | U S TREASURY BOND4.125% 08/15/2053 DD 08/15/23 | 3,096 | 0.42% | TREASURIES |

| 8 | U S TREASURY NOTE4.000% 02/28/2030 DD 02/28/23 | 3,063 | 0.41% | TREASURIES |

| 9 | CHINA GOVERNMENT BOND2.680% 05/21/2030 | 3,054 | 0.41% | TREASURIES |

| 10 | JAPAN GOVERNMENT TWO YEAR BOND0.100%11/01/2025 | 3,025 | 0.41% | TREASURIES |

Data on assets by sector, geography, issuer or type as of the end of the fiscal year is disclosed in the third quarter of the following year according to Article 25 of the Guideline for National Pension Fund Management and Article 39 of the Regulation on National Pension Fund Management.