content

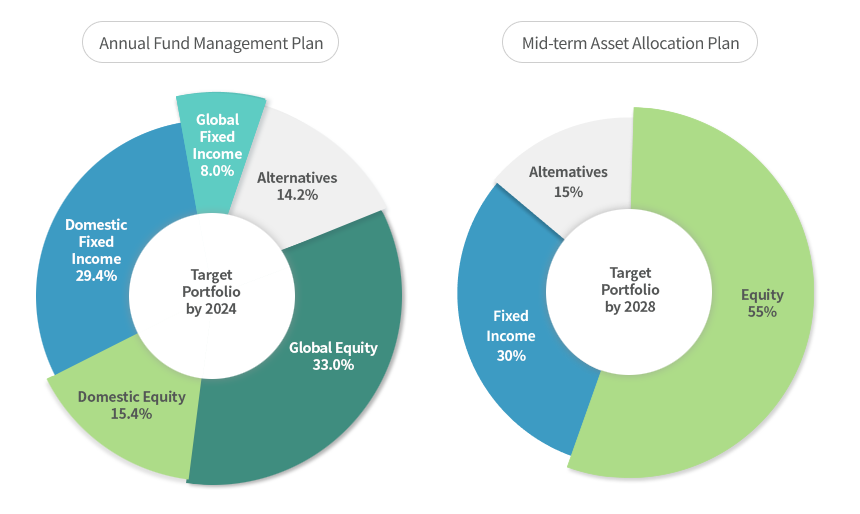

Asset Allocation

The National Pension Fund is managed according to fund management plans approved by the National Pension

Fund Management Committee (FMC). The FMC, the highest decision-making body, deliberates and approves

investment policies including asset allocation plans and target returns.

A mid-term asset allocation plan with a time horizon of five years presents an initial target portfolio,

together with target return and risk tolerance. To facilitate the implementation, an annual fund management

plan is formulated given global economic and financial market conditions. Consequently, the

annual fund management plan guides the transition process of the investment portfolio.

Annual Asset Allocation Plan

Target Portfolio by 2025

- Domestic Fixed Income 26.5%

- Domestic Equity 14.9%

- Global Equity 35.9%

- Global Fixed Income 8.0%

- Altematives 14.7%

Mid-term Asset Allocation Plan

Target Portfolio by 2029

- Equity 55%

- Fixed Income 30%

- Altematives 15%

Target Return & Risk Tolerance

- Target Return(%): Real GDP Growth (%) + CPI Growth (%) ± Adjustments

- Risk Tolerance: CVaR (α =0.05) ≥ -15%